|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Protection Insurance: Coverage Guide for U.S. ConsumersCar protection insurance, also known as an extended auto warranty, offers peace of mind by covering repair costs that arise after your manufacturer's warranty expires. For U.S. consumers, understanding the nuances of car protection insurance can lead to significant cost savings and ensure your vehicle remains in top condition. Why Consider Car Protection Insurance?Owning a car involves more than just the initial purchase price. Unexpected repair costs can be a financial burden. Car protection insurance helps to mitigate these costs, providing coverage for parts and labor, and ultimately offering peace of mind. Benefits of Car Protection Insurance

For those in areas like California or New York, having this insurance can be particularly beneficial given the higher repair costs in urban centers. What's Covered?Most car protection insurance policies cover a wide range of components, but it's crucial to understand the specifics. Here's a general overview: Common Coverage Inclusions

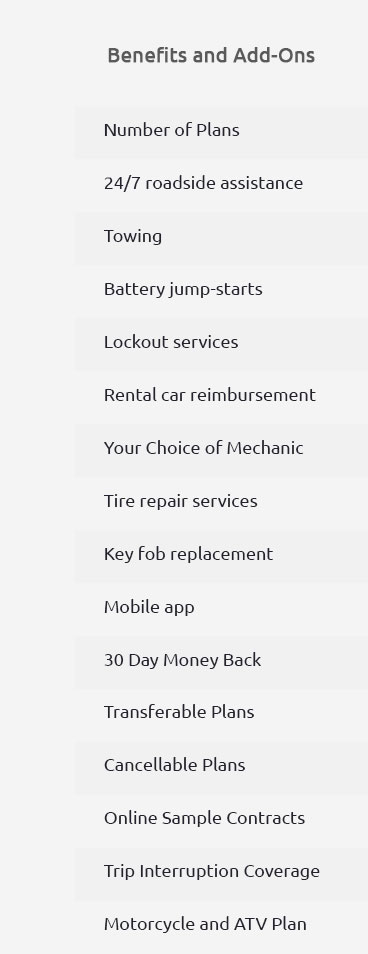

Exclusions to Be Aware OfWhile many components are covered, some items like routine maintenance and wear-and-tear parts (e.g., brake pads, tires) typically are not. Always read the fine print to know what's excluded. How to Choose the Right PlanSelecting the right car protection insurance involves considering your vehicle's age, mileage, and typical repair costs. It's also wise to compare different providers and their offerings. For example, if you're considering a Cadillac extended warranty cost, look at the coverage options specific to your model and driving needs. Research and Compare

For luxury vehicle owners, like those with a Lexus, exploring a Lexus extended warranty price can offer tailored coverage that aligns with premium vehicle needs. FAQs About Car Protection InsuranceWhat is the difference between a manufacturer's warranty and an extended warranty?A manufacturer's warranty covers a new vehicle for a specific period or mileage, typically addressing defects and major repairs. An extended warranty, or car protection insurance, extends coverage beyond the manufacturer's warranty, covering similar issues for a longer duration. Can I purchase car protection insurance after my manufacturer's warranty expires?Yes, you can purchase car protection insurance even after the original warranty expires, though the terms and costs may vary based on the vehicle's condition and age. Does car protection insurance cover all repair costs?While car protection insurance covers many major components, it often excludes routine maintenance, wear-and-tear items, and cosmetic repairs. Always review your policy details for specific coverage information. https://www.protectiveassetprotection.com/f-i-solutions/automotive/vehicle-service-contracts/protective-vehicle-protection-plan

Advanced autos need advanced coverage. The Protective Vehicle Protection Plan is designed to meet the growth of technology in today's vehicles. The auto ... https://www.zurichna.com/industries/auto/owners/vehicle-protection

Vehicle protection products address specific risks, from theft to environmental damage, and can help you handle the unforeseen costs of vehicle ownership. https://feeservices.americanexpress.com/premium/car-rental-insurance-coverage/home.do

Get premium car rental insurance coverage without the premium price with up to $100000 of insurance coverage from American Express Travel Related Services ...

|